MicroStrategy Expands Bitcoin Holdings with $155.4 Million Purchase

MicroStrategy adds 3,000 BTC to its portfolio with a $155.4 million investment. Learn more about the company's Bitcoin acquisition and its impact on the cryptocurrency market.

MicroStrategy, a prominent business intelligence firm, has made a significant addition to its Bitcoin holdings with a recent purchase of 3,000 BTC. The company invested a total of $155.4 million in this acquisition, which has brought its total Bitcoin portfolio to approximately 193,000 BTC. This move reflects MicroStrategy's continued bullish outlook on Bitcoin and its commitment to expanding its cryptocurrency assets.

The average purchase price per Bitcoin in this acquisition was around $51,813, inclusive of related fees and expenses. To fund this strategic purchase, MicroStrategy utilized proceeds from share sales as well as its available cash reserves. The company's ability to allocate such a substantial amount towards Bitcoin highlights its confidence in the long-term value and potential of the cryptocurrency.

With its latest purchase, MicroStrategy now holds a Bitcoin portfolio worth over $10 billion. This not only solidifies the company's position as one of the largest institutional holders of Bitcoin but also demonstrates its belief in Bitcoin as a reliable store of value and an effective hedge against inflation.

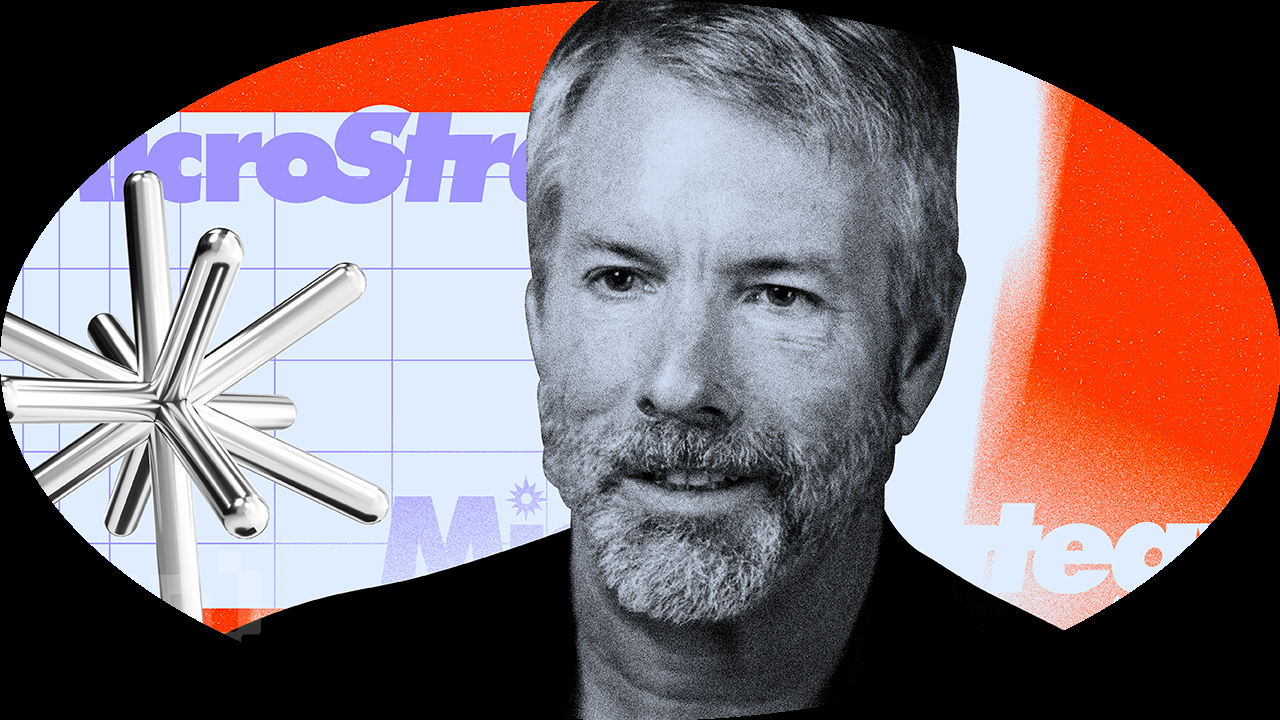

MicroStrategy's continuous accumulation of Bitcoin has garnered attention and admiration from the crypto community. The company's CEO, Michael Saylor, has been a vocal advocate for Bitcoin, often referring to it as digital gold. MicroStrategy's unwavering commitment to Bitcoin has influenced other institutions and corporations to consider adding Bitcoin to their balance sheets as well.

However, amidst MicroStrategy's impressive growth in the cryptocurrency space, the company recently faced a cybersecurity breach. The breach involved a phishing scheme that targeted the company's followers and resulted in financial losses for some individuals. It is a reminder of the importance of robust cybersecurity measures in the crypto industry and the need for users to exercise caution and verify the authenticity of information and announcements.

MicroStrategy's continued accumulation of Bitcoin not only strengthens its position as a major player in the cryptocurrency market but also contributes to the overall growth and adoption of Bitcoin. As more institutional investors and companies recognize the potential of Bitcoin as a valuable asset, the cryptocurrency market is likely to experience further expansion and maturation.

In conclusion, MicroStrategy's recent purchase of 3,000 BTC for $155.4 million further solidifies its commitment to Bitcoin and its belief in the cryptocurrency's long-term potential. As an influential player in the industry, MicroStrategy's actions have a significant impact on the cryptocurrency market. The company's continuous accumulation of Bitcoin sets a precedent for other institutions and corporations to consider adding Bitcoin to their investment portfolios. With its extensive Bitcoin holdings, MicroStrategy is well-positioned to benefit from the future growth and success of the cryptocurrency.

What's Your Reaction?